The following information has been obtained from Valutech databases and the comments offered reflect the views of the company. These views are not based on whether we regard certain stock as worth investing from a speculative point of view. Rather, they represent our assessment as to whether there is technical and commercial substance in the companies reviewed. For investment advice, we recommend that investment analysis reports be studied and potential investors reach their own views.

Comments on individual companies can be accessed through the menu above or through the following Navigation Bar.

Listed Biotechnology Companies in 2004 – 2018

2018

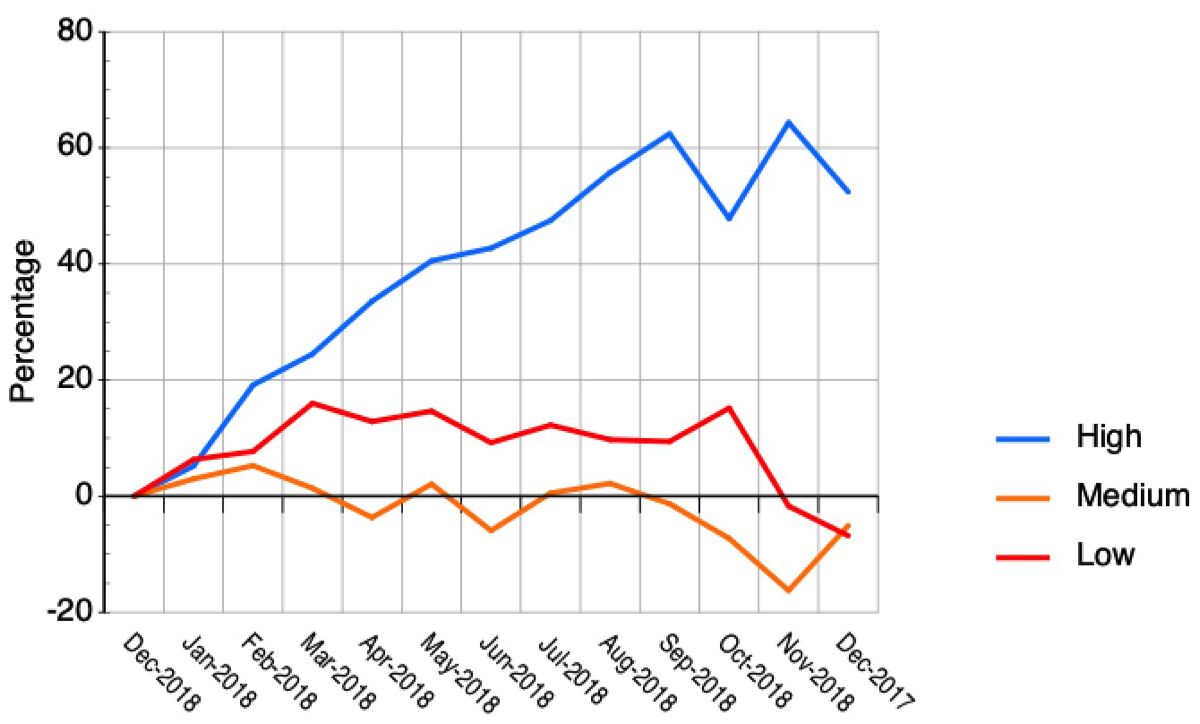

Of the higher valued stocks, notable improvers in 2018 are Paradigm Biopharma up 243%, Viralytics up 152% (delisted following acquisition by Merck), Clinuvel up 121%, pSivida (delisted) up 106%, Sirtex Medical up 103% (delisted following acquisition by CDH Investments), Cynata Therapeutics up 94%, Clover Corp up 84%, Probiotec up 68%, ResMed up 44% and CSL up 32%, but Anatara Lifesciences is down 75%, Noxopharm down 61%, Neuren Pharma down 56%, Vectus Biosystems down 55%, Somnomed down 52%, Cogstate down 33%, Ellex Medical down 33%, Starpharma down 29% and Opthea down 20%. Of the cheaper stocks, Biotron is up 297%, Bard1 up 214%, Invion up 200%, Resonance Health up 195%, SciGen up 127% (delisted following acquisition by Yifan International Pharma), Respiri up 111%, RHS up 96% (delisted following acquisition by Perkin Elmer), IDT up 61%, Living Cell Technologies up 48%, Proteomics International up 43%, ResApp Health up 41%, Regeneus up 40%, Antisense Therapeutics up 38% and Patrys up 30%, but for the significant losers in 2018, there have been Factor Therapeutics down 96%, Medibio down 94%, Race Oncology down 85%, Impedimed down 81%, Admedus down 79%, Neurotech International down 78%, Phosphagenics down 72%, Bionomics down 71%, Cryosite down 64%, Bioxyne down 64%, Suda Pharma down 63%, Adherium down 62%, Orthocell down 56%, Optiscan down 55%, Genetic Technologies down 54%, Medlab Clinical down 53%, OBJ down 53%, Stemcell United down 53%, LBT Innovations down 52%, Leaf Resources down 52%, Prana Biotech down 52%, Cellmid down 51%, Amplia Therapeutics down 50%, Rhythm Biosciences down 50%, Total Brain (Brain Resource) down 50%, Bio-Gene Technologies down 49%, Uscom down 48%, Benitech Biopharma down 43%, GI Dynamics down 43%, Sienna Cancer Diagnostics down 41%, BTC health down 39%, Novita Healthcare down 36%, Secos Group down 35%, Cannpal Animal Therapeutics down 33%, Cogstate down 33%, Holista Colltech down 33%, Medigard down 33%, Pharmaust down 33%, Universal Biosensor down 33% and Phylogica down 30%. In January, stock prices rose 5.7%, rose 4.2% in February, up 4.5% in March, down 1.8% in April, up 4.3% in May, down 3.5% in June, up 4.1% in July, down 0.9% in August, up 0.6% in September, up 3.8% in October, down 7.6% in November and down 5.4% in December and up 1.1% for the year as a whole.

Biotechnology Optimism Index

(an index of shareholders expectations)Seconds to Midnight Index

(companies that need to think quickly before the bewitching hour)Paradigm Biopharma

Biotron

Leaf Resources

Respiri

Recce Pharma

ResApp Health

Noxopharm

Oncosil Medical

Dimerix

Cynata Therapeutics

AdAlta

Phylogica

Patrys

Telix Pharmaceuticals

10.0

10.0

10.0

10.0

10.0

10.0

10.0

8.8

7.8

7.2

7.2

5.8

5.6

5.5

5.2

Adherium

Total Brain (Brain Resource)

GI Dynamics

Race Oncology

Neurotech International

Admedus

Factor Therapeutics

Phosphagenics

Cryosite

Prana Biotechnology

Amplia Therapeutics

IDT

TBG Diagnostics

Acrux

16

32

49

77

81

81

91

93

93

102

110

111

121

123

127

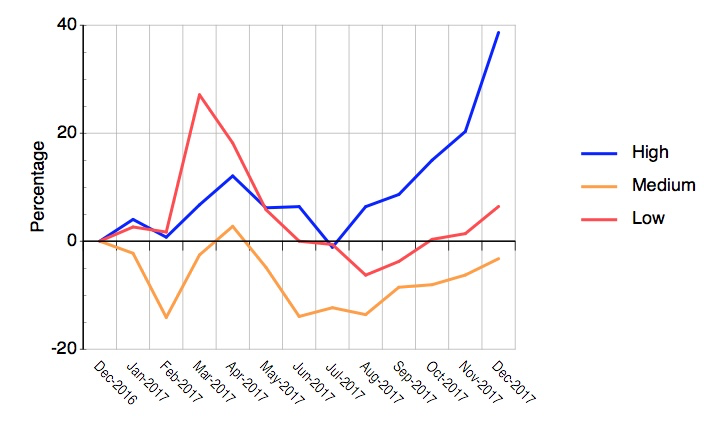

2017

For the year overall, notable developments were the jump in the cheaper, more speculative stocks in the first half of the year, their fading out and the gradual increase in the higher valued more substantial stocks in the latter half of the year. Overall, the mid priced stocks languished. Also notable was the departure of Unilife through bankruptcy (the last of the rash of safety syringe companies that were set up over a decade ago).Of the higher valued stocks, Cochlear and CSL continued with their consistent rise, newcomer companies such as Anatara and Starpharma gained maturity and some stocks such as Neuren Pharma and Noxopharm gained through consolidation and speculation.. Of the cheaper stocks, some gained through speculation such as Bioxyne, Patrys, Invion, Stem Cell United, Benitech Biopharma and Oncosil but it remains to be shown that these gains can be consolidated Some companies such as Innate Immunotherapeutics, Bard1, ResApp Health, Living Cell Technologies suffered from problematic trial results and others such as Anteo Diagnostics, Memphasys, Adherium, Acrux, IDT, Avita Medical, Neutotech International, Atcor and LBT Inovation suffered from a lack of direction as perceived by the market.

Of the more expensive stocks in 2017 notable improvers were Neuren Pharma up 186%, Noxopharm up 169%, Starpharma up 88%, Probiotec up 80%, Polynovo up 79%, Anatara Lifesciences up 65%, CSL up 41%, Clover Corp up 40%, Cochlear up 40% and ResMed up 28% but Compumedics was down 52%, Kazia (Novogen) down 46%, pSivida down 44%, Viralytics down 42%, Ellex Medical down 31% and Cogstate down 27%. Of the cheaper stocks, Bioxyne was up 411%, Patrys up 283%, Invion up 200%, Stemcell United up 186%, BTC health up 100%, Benitech up 82%, Oncosil up 80%, SciGen up 76%, Optiscan up 67%, Novita Healthcare up 63%, Phylogica up 60%, Prana Biotech up 54%, Botanix up 50%, Medigard up 43%, RHS up 43%, Rhythm Biosciences up 40% and AdAlta up 35%, but Innate Immunotherapeutics was down 97%, Unilife (delisted) down 90%, Bard1 down 79%, ResApp Health down 79%, Living Cell Technologies down 70%, TBG Diagnostics down 66%, Anteo Diagnostics down 61%, Memphasys down 60%, Adherium down 58%, Acrux down 52%, IDT down 50%, Avita Medical down 48%, Neurotech International down 48%, Atcor Group down 47%, LBT Innovations down 47%, Sienna Cancer Diagnostics down 45%, Actinogen down 43%, OBJ down 42%, Brain Resource down 40%, Immutep (Prima Biomed) down 39%, Cryosite down 38%. Phosphagenics down 38%, Antisense Therapeutics down 33% and Immuron down 30%. In January, stocks rose 2.35%, fell 2.6% in February, rose 21.3% in March, down 0.6% in April, down 8.5% in May, down 3.2% in June but up 2.0% in July, down 2.1% in August, up 7.8% in September, up 3.0% in October, up 4.5% in November and up 5.8% in December (up 8.8% in 2017 overall) .

2016

Of the more expensive stocks in 2016, notable improvers are Innate Immunotherapeutics up 476%, Medilab Clinical up 325%, Clinuvel Pharma up 183%, Compumedics up 120%, Opthea up 111%, Cogstate up 106%, Cynata Therapeutics up 106%, Ellex Medical up 87%, Viralytics up 80%, Somnomed up 46%, Clover Corp up 35% and Cochlear up 28%, but Sirtex is down 65%, pSivida down 60% and Mesoblast down 23%. Of the cheaper stocks, LBT Innovations is up 250%, ResApp Health up 248%, Phosphagenics up 142%, Optiscan up 107%, Phylogica up 92%, Neurotech International up 90%, Living Cell Technologies up 78%, Regeneus up 76%, Medigard up 75%, Imugene up 58%, Factor Therapeutics up 51%, Uscom up 40% and OBJ up 30%, but Alchemia has fallen 92% (return of capital to shareholders), Memphasys down 88%, Stem Cell United down 83%, Atcor Group down 68%, Invion down 67%, Oncosil down 66%, Adherium down 63%, Benitech Biopharma down 63%, Novita Healthcare down 61%, Acrux down 59%, Unilife Corp down 58%, Prana Biotech down 57%, Genetic Technologies down 56%, IDT down 51%, Neuren Pharma down 51%, Anteo Diagnostics down 50%, Antisense Therapeutics down 49%, Admedus down 47%, Brain Resource down 47%, Immuron down 45%, PharmAust down 32% and Universal Biosensor down 31%. In January, stocks fell 2.3%, 6.4% in February but rose 6.4% in March, 7.3% in April, 0.3% in May but down 4.4% in June, up 12.9% in July, down 1.7% in August, up 2.2% in September, up 5.8% in October, down 2.4% in November and down 0.6% in December.

2015

As indicated in the graph below, many medium priced stocks came of age in 2015. The enigma of commercialisation of stem cell technology remains following problems of Mesoblast in raising funds through an IPO in the US (stem cell stocks down 26%). Several companies left the ASX list during the year including Solagran which had an astronomic value prior to the breaking of the Opes Prime crisis. Other companies like Stirling, Telesso and Acuvax were finally given last rites and other companies with a less than flattering past like Pharmanet and QRxPharma are likely to follow. While few of the more expensive stocks showed major changes, other than Impedimed and Sirtex, the medium stocks starred, particularly device companies where years of preparation finally paid off. These include Ellex Medical, Universal Biosensor, Compumedics, Impedimed and Sirtex. Mid-priced stocks also showed a significant uplift for pharmaceutical development or novel treatment companies such as Bionomics, Immuron, Opthea, Viralytics and Starpharma. However the journey for these companies has just started and they will need to provide similar advances in coming years. Of the cheaper stocks, there are few leading lights and most are looking for a justification for existence.Of the more expensive stocks, notable improvers were Anatara Lifesciences up 223%, Cogstate up 195%, Immuron up 180%, Ellex Medical up 173%, Universal Biosensor up 150%, Opthea up 142%, Viralytics up 124%, Probiotec up 80%, Starpharma up 43%, Impedimed up 41%, Sirtex up 41%, pSivida up 29%, Adherium up 29%, Cochlear up 23% and CSL up 21%, but Mesoblast is down 58%, Acrux down 42%, Admedus down 43% and Clinuvel Pharma down 37%. Of the cheaper stocks, improvers were ResApp Health up 556%, Compumedics up 334%, PolyNovo up 222%, Oncosil up 191%, Pharmaxis up 167%, IDT up 147%, Atcor Medical up 124%, Genetic Technologies up 67%, Holista Colltech up 60%, Bioxyne up 57%, Prima Biomed up 55%, Agenix up 43%, Actinogen up 36%, Leaf Resources up 35%, SciGen up 33%, QRxPharma up 33% and Genera Biosystems up 32%, but GI Dynamics is down 88%, Invion down 87%, Tissue Therapies down 86%, Phosphagenics down 84%, Unilife Corp. down 83%, Avexa down 78%, Analytica down 74%, Benitec down 69%, Medigard down 64%, Suda down 54%, Biotron down 51%, Patrys down 50%, Tyrian Diagnostics down 50%, Optiscan down 47%, Pharmaust down 47%, Prana Biotech down 47%, OBJ down 45%, Secos Group down 45%, NuSep down 44%, Admedus down 43%, Regeneus down 41%, Respiri down 41%, Cryosite down 40%, Resonance Health down 39%, Anteo Diagnostics down 32% and Phylogica down 32%. In January, stocks rose 2.0%, 6.7% in February, 1.0% in March and 3.5% in April, up 3.9% in May but down 7.5% in June then up 7.8% in July and down 8.2% in August but up 3.9% in September, up 10.3% in October but down 0.6% in November and up 1.7% in December (up 21.6% for the year).

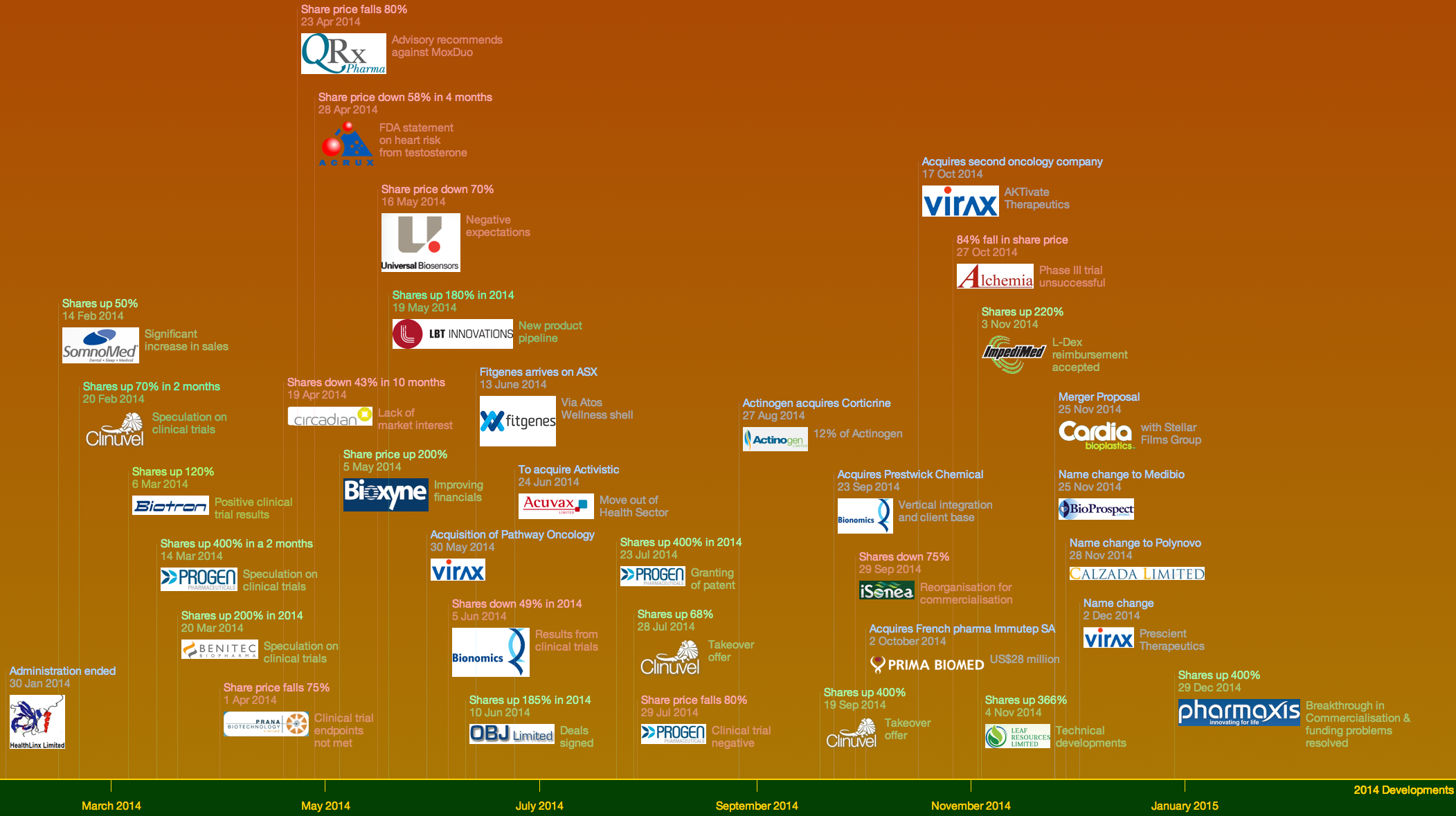

2014

Of the more expensive stocks, notable improvers have been Clinuvel Pharma up 342% (takeover offer), Impedimed up 241%, Somnomed up 145%, Sirtex up 142%, Benitec Biopharma up 66%, Cochlear up 32%, ResMed up 31% and CSL up 26%, but Acrux is down 50%, Bionomics down 43%, Starpharma down 39% and Mesoblast down 25%. Of the cheaper stocks, improvers have been Biotech Capital up 268%, OBJ up 191%, Leaf Resources up 161%, Actinogen up 105%, Tyrian Diagnostics up 100%, Uscom up 43%, Bioxyne up 40, Biotron up 38%, Avexa up 33% and Genera Biosystems up 31%, but QRxPharma is down 97%, Bone Medical down 90%, Alchemia down 84%, iSonea down 79%, Prana Biotech down 74%, Genetic Technologies down 73%, SciGen is down 73%, Patrys down 69%, GI Dynamics down 68%, Regeneus down 65%, Universal Biosensor down 61%, Prescient Therapeutics (Virax) down 58%, IDT down 60%, Immuron down 51%, Holista Colltech down 50%, Novogen down 45%, Cogstate down 44%, Invion down 44%, Atcor Medical down 42%, Clover Corp. down 42%, Imugene down 41%, Antisense Therapeutics down 40%, Avita Medical down 39%, Probiotec down 38%, Phosphagenics down 35%, Resonance Health down 35%, Cardia Bioplastics down 33%, Oncosil down 33% and Cynata Therapeutics down 32%. Overall stocks rose 5.7% in January 2014, 0.6% in February and 3.3% in March, fell 9.4% in April but rose 1.4% in May, fell 0.4% in June, rose 4.4% in July and 6.8% in August, down 1.8% in September, down 4.3% in October, down 1.5% in November and up 4.6% in December.

Sectoral Observations

Stem Cells

Prices of companies in this sector fell by an average of over 40% in 2014 indicating that this remains a high risk area until there is clear clinical evidence from human trials that stem cell technology can achieve the potential cures many have been promoting. Some four or five Australian stem cell companies are undertaking valuations as part of private equity raising with a view to eventual IPOs but this area remains high risk until clear clinical evidence is available.How did the Pundits Go?

In reviewing the past year, it is always interesting to see how the pundits went. Of the 29 companies highlighted at the beginning of the year by four pundits, five (BLT, SRX, SOM, NAN and IPD) were winners, fourteen (ACL, ACR, CGS, GID, IVX, MSB, RGS, PAB, AVH, OSL, QRX, RNO, SPL, UBI) were losers and the remaining ten ( ALT, AHZ, CDY, DVL, IIL, LCT, NEU, OSP, TIS, VLA) were indifferent. Some of the movers that were not picked at the beginning of the year were CUV, BTC, OBJ and LER. Pundit 1 achieved 2 winners and 4 losers, pundit 2, one winner and 5 losers, pundit 3 three winners and three losers and pundit 4 one winner and four losers. This highlights the difficulty of any critical analysis of the biotechnology area even by those who are reviewing the industry full time. (See our review for 2011 below to see that the strike rate has changed little in the last four years.)

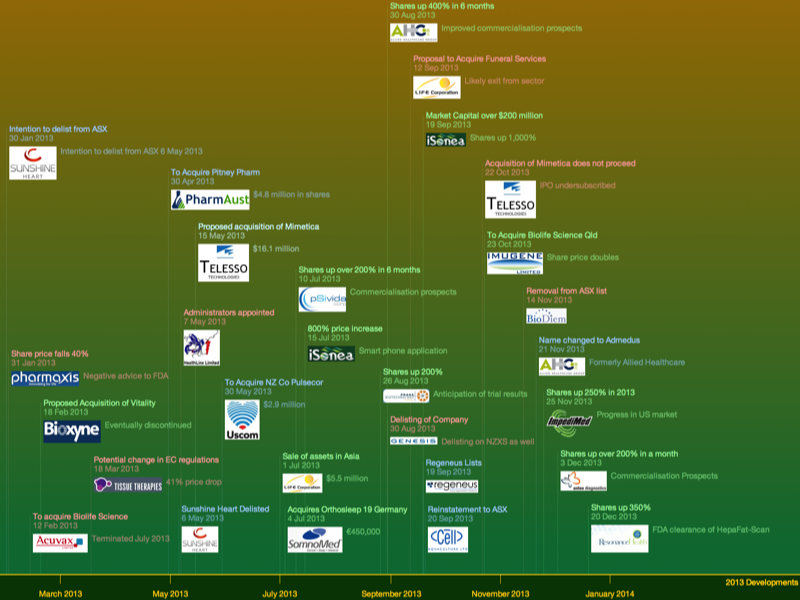

2013

It was a good year for biotechnology stocks with significant improvers in the mid and low end stocks which has pushed up the indices significantly. Of the more expensive stocks, notable improvers have been Prana Biotech up 267%, pSivida up 249%, Unilife up 133%, Bionomics up 110%, Benitec up 64%, Alchemia up 48%, GI Dynamics up 36%, ResMed up 35%, Somnomed up 35%, CSL up 28% and Cryosite up 21%, but Universal Biosensor was down 50%, Clinuvel Pharma down 48%, Starpharma down 33% and Cochlear down 26%. Of the cheaper stocks, improvers have been Admedus (formerly Allied Healthcare) up 638%, iSonea up 379%, Resonance Health up 250%, Neuren Pharma up 229%, Impedimed up 206%, BioProspect up 200%, Anteo Diagnostics up 154%, Atcor Medical up 143%, Cellmid up 93%, Ellex Medical up 89%, Medigard up 75%, OBJ up 74%, IDT up 70%, Calzada up 68%, Pharmaust up 57%, Living Cell Technologies up 56%, Imugene up 55%, Cardia Bioplastics up 50%, Invion up 47%, LBT Innovations up 39%, SciGen up 38%, Holista Colltech up 37%, Patrys up 37% and Antisense Therapeutics up 36%, but Pharmaxis fell 92% (FDA knock back on Bronchitol), Virax Holdings down 86%, Prima Biomed down 65%, Cell Aquaculture down 55%, Healthlinx 50%, Pharmanet down 50%, Biotron down 44%, Optiscan down 44%, Circadian down 41%, Avexa down 37%, Phylogica down 32% and Uscom down 30%. Overall stocks rose 4.2% in January and 6% in February but declined 5.3% in March, 2.7% in April/May and 2.9% in June but rebounded 23.6% in July, up 2.6% in August, up 3.6% in September, up 10.9% in October, up 8.6% in November and up 0.9% in December.

2012

After the poor showing in 2011 with general losses in both expensive and cheap stocks, it was expected that there would be some recovery in 2012 and some stocks, particularly the promising high to mid-range stocks, have shown increases in the first four months of 2012, particularly Starpharma, Acrux, Psivida and Alchemia. However in May there was some correction across the board and since then, the prices of the expensive stocks have been sustained but the medium and cheaper stocks have languished.In January, notable movers were Clinuvel Pharma up 35%, Unilife Corp up 27%, Acrux up 19%, ResMed up 11%, Bone Medical up 60%, Analytica up 58%, CBio up 52%, Benitec Biopharma up 27% and Genetic Technologies up 23%. However, Bionomics fell 20% and Psivida 17%. Overall stocks rose 3% in the month with more expensive stocks the most improved.

In February, there were significant improvements in selected stocks with the most notable being in the expensive stocks - pSivida up 123% and QRxPharma, Mesoblast and GI Dynamics up 18% although Clinuvel declined 18%. Middle stocks were indifferent with only Alchemia up 40%. Notable upticks in the cheaper stocks were Bone Medical up 88%, Prima Biomed up 52%, Living Cell Technologies up 51%, Avita Medical up 44%, Ellex Medical up 36% and Uscom up 32%. Significant falls were CathRx down 50%, NuSep down 34%, SciGen down 34%, Immuron down 29% and Solagran down 29%. Overall increase since the beginning of the year was 3.6%.

In March, the trend of the previous two months continued: more expensive stocks increasing, cheaper stocks languishing. Notable in the former category were Biota up 31%, Pharmaxis up 26%, Starpharma up 22% and Alchemia up 16% while pSivida fell 16% and Somnomed fell 10%. In the latter category, increases by Avita Medical up 33%, Calzada up 29% and Tissue Therapies up 24% were more than offset by losses with CathRx down 63%, Actinogen down 60%, NuSep down 56%, Imugene down 38% and Sunshine Heart down 28%. Overall increase since the beginning of the year was 4.3%.

In April, the trend noted above continued. Improvers in the more expensive stocks were pSivida up 24%, Sirtex up 24% and Unilife up 16% but Bionomics fell 15% and Biota fell 15% on announcement of merger and move to US. For the cheaper stocks, notable improvers were CathRx up 153%, NuSep up 59%, Cordlife up 27%, Genera Biosystems up 24% and Cogstate up 19%. Notable declines occurred with Holista Colltech down 57%, Avita Medical down 17% and Probiotec down 15%. Overall increase since the beginning of the year was 3.4%.

In May there was an 8% fall across the board due to uncertainty associated with European financial crisis. Notable declines in expensive stocks were pSivida down 19%, Universal Biosensor down 18%, Starpharma down 15%. Alchemia down 13% and Pharmaxis down 13%. For the cheaper stocks there were few winners with Genetic Technologies up 70% and Imugene up 44%. Significant losers were Agenix down 60%, Cell Aquaculture down 47%, Bone Medical down 45%, CathRx down 39%, HealthLinx down 38%, Progen down 37% and Prima Biomed down 30%. Overall decrease since the beginning of the year was 5.9%.

In June, stocks were battered (down 9% overall) particularly at the medium and low end. At the expensive end, while pSivida increased 13%, QRxPharma fell 68% (set back with FDA approval), Starpharma down 14% and Pharmaxis down 11%. For the cheaper stocks, the falls were more noticeable. While NuSep increased 43% and Calzada 36%, there were a large number of falls with the most notable being Bioxyne down 82% (trial results), CathRx down 78%, Leaf Energy down 43%, Ellex Medical down 32%, Circadian down 27%, Allied Health down 25%, Biotron down 25% and Genetic Technologies down 25%. Overall decrease since the beginning of the year was 14.6%.

In July, there was some recovery (up 6%). Notable improvers were pSivida up 27%, QRxPharma up 22%, Ellex Medical up 78%, IDT up 33%, Progen up 36%, Sunshine Heart up 100% and Uscom up 28%. Notable declines were Unilife down 18%, Cordlife down 28% and Brain Resource down 21%. Overall decrease since the beginning of the year was 11.7%.

In August, the status quo was maintained. For the expensive stocks, declines by pSivida (42%), Unilife (13%), Acrux (12%) and GI Dynamics (11%) were matched by increases to ResMed (21%), Sirtex (21%) and Alchemia (14%). For the cheaper stocks, in the main the pain continued. Notable improvers were iSonea (63%), Uscom (42%), Compumedics and Probiotec (40%), Leaf Energy (37%), Bionomics (32%) and NuSep (30%). Notable declines were IDT (25%), Impedimed (30%) and Optiscan (22%). Overall decrease since the beginning of the year was 13.0%.

September and October was a period of continuing improvement, particularly in the more expensive stocks. Of the more expensive stocks, improvers were Viralytics up 76%, Universal Biosensor up 57%, Sirtex up 43% and Clover up 22% while losers were GI Dynamics down 29% and Biota and pSivida both down 14%. Of the cheaper stocks, notable improvers were Prana Biotech up 59%, Biotron up 46%, Cogstate up 38%, Cryosite up 37%, NuSep up 34% and Progen up 30%. The notable loser was Compumedics down 43%. Overall decrease since the beginning of the year was 7%.

In November, there were notable changes with delisting of Biota, suspension of Genesis R&D (out of funds), voluntary administration of Cell Aquaculture, unseating of board members of Genetic Technologies and fall in share price of Starpharma due to clinical trial results. Of the more expensive stocks, the improver was Clinuvel Pharma up 16% but Starpharma fell 29% and Acrux 12%. For the cheaper stocks, Patrys rose 37% and Novogen 31% but the overall trend was down with Agenix down 41% (consolidation), Avexa down 35%, Genetic Technologies down 35% (board upheaval), Impedimed down 33%, Viralytics down 30% and NuSep down 26%. Overall decrease since the beginning of the year was 11.7%.

In December, the demerger of Alchemia was halted, CathRx was delisted and there were some recoveries in stocks that had previously been mauled (QRX, SPL, TIS and NRT). Of the more expensive stocks, there were improvements by QRxPharma up 15%, Sirtex up 13% and Starpharma up 12% but falls by Alchemia (demerger problems) down 25%, GI Dynamics down 15% and Mesoblast down 12%. Of the cheaper stocks, noticeable improvers were Novogen up 94% (new business), Compumedics up 35% and Cryosite up 23% with notable declines being Bioxyne down 53%, Agenix down 47% and Genera Biosystems down 20%. Overall decrease since beginning of the year was 9.9%.

Of the expensive stocks in 2012, the winners have been Sirtex up 193%, CSL up 68%, ResMed up 60%, Cochlear up 28% and Pharmaxis up 19%. Only loser is Mesoblast down 23%. Average increase of 38.0%.

For the medium stocks, the winners have been Clover Corp up 93% and Universal Biosensor up 22% and the main losers have been GI Dynamics down 41%, QRxPharma down 40% and Biota down 29%. Average increase of 3.3%.

For the cheaper stocks, winners have been Uscom up 199%, Cryosite up 162%, Novogen up 65%, Progen Pharma up 50%, Ellex Medical up 46%, Cogstate up 38%, Resonance Health up 38%, Prana Biotech up 35% and Neuren Pharma up 30%. Significant losers are Bioxyne down 93%, CathRx down 93%, Agenix down 92%, Impedimed down 85%, HealthLinx down 83%, Actinogen down 80%, Immuron down 80%, Cardia Bioplastics down 78%, Bioprospect down 75%, Pharmanet down 67%, Bone Medical down 60%, Pharmaust down 53%, Antisense Therapeutics down 52%, Biotech Capital down 51%, BioDiem down 50%, iSonea down 50%, Tyrian Diagnostics down 50%, Allied Health down 48%, Cell Aquaculture down 47%, Telesso Technologies down 47%, IDT down 44%, SciGen down 41%, Avexa down 39%, Bionomics down 39%, Phylogica down 38%, Genesis R&D down 37%, Holista Colltech down 37%, Narhex Life down 36%, Genetic Technologies down 35%, Cordlife down 34%, Phosphagenics down 33%, Solagran down 33%, Unilife down 32%, Phosphagenics down 31%, Prima Biomed down 31% and Optiscan down 30%. Average decrease of 17.9%.

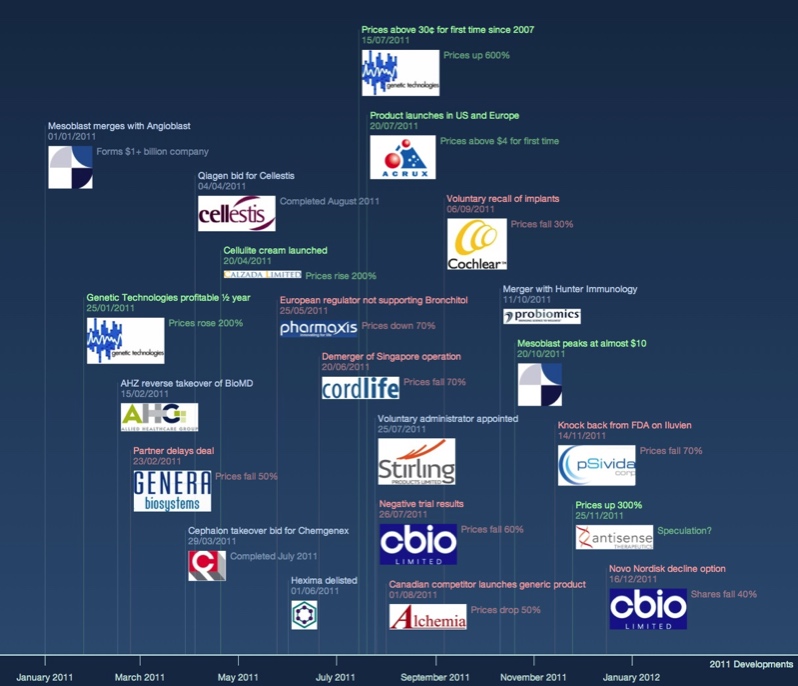

2011

It was a difficult year for the Australian biotechnology sector with an overall fall in share prices of around 20% particularly in the cheaper stocks as shown by the graph below. While good news could be found with the Mesoblast merger which lifted company value well above $1 billion and the acquisition of Chemgenex Pharma by Cephalon and Cellestis by Qiagen for inflated prices, it was a year of overall contraction. There was a continuing shift of biotechnology companies diversifying as part of a shift out of the sector and generally back to resources including BioProspect, Biotech Capital, Fermiscan, Fluorotechnics, Norwood Abbey, Narhex Life Sciences, PharmAust and Xceed Capital. Other companies lost shareholder support due to delays in commercialisation (Alchemia, Genera Biosystems, HealthLinx, Imugene and Tyrian Diagnostics), clinical trial or regulatory setbacks or product warnings (Cochlear, Pharmaxis, Psivida and CBio) or demergers (Cordlife). Hexima exited the market due to lack of support. Going against the trend were Mesoblast, Starpharma, Bionomics, Genetic Technologies, Antisense Therapeutics, Calzada and Phosphagenics. A number of mergers were also completed or are in process including the absorption of BioMD by Allied Health Group, Probiomics with Hunter Immunology and Genesis R&D with Mariposa Health.The difficulty of determining what is happening in the industry is highlighted by comparing expectations at the beginning of 2011 with the eventual results. One high profile biotechnology analyst projected big things for ten stocks at the beginning of 2011. Two went nowhere, Somnomed and Sunshine Heart. Two improved, Bionomics up 90% and Starpharma up 37%. Six declined markedly, Alchemia (52%), Biota (19%), Clinuvel Pharma (25%), Pharmaxis (65%), Phylogica (38%) and Sirtex (26%).

In January, there were a number of significant developments. Mesoblast rose 24% with the merger with Angioblast making it a $1+ billion company. Genetic Technologies also recorded its first half year profit and rose 218% in association with this. Other movers were Biota up 29% with increased expectations for the future, Novogen up 117% on hopes of maintaining a NASDAQ status through an associated company, CBio up 63% on speculation over clinical trials. However, stocks were generally up across the board but particularly with the cheaper stocks (up 8.3% in January).

In February stocks were generally up 2.3% with the most notable rises being in the mid stocks but there were falls in the some of the more expensive stocks. Biota fell 16%, Mesoblast down 10%, Psivida down 25% and Universal Biosensor down 10%. Midstock improvers were CBio up 61%, Progen up 24% and Starpharma up 16% although Chemgenex fell 15% and Genera fell 36%. Notable movers in the cheaper stocks were Analytica up 64%, Brain Resource up 24%, Calzada up 46%, Resonance up 35% and Viralytics up 47% while CathRx fell 21%, Living Cell down 19% and Novogen down 35%. Overall increase since the beginning of the year was 10.3%.

In March there was significant movement in selected stocks but overall, stocks fell 1.2%.. For the more expensive stocks main movers were Chemgenex Pharma up 52% (takeover offer), Bionomics up 41%, Mesoblast up 39%, Starpharma up 20% and CBio up 19%. Losers included IDT down 19%, Clinuvel down 17% and Probiotec down 12%. For the cheaper stocks, main improvers were Prana Biotech up 61%, Novogen up 59% and Antisense Therapeutics up 44% whereas losers were Fermiscan down 70%, Acuvax down 67%, Actinogen down 40%, Holista Colltech down 36% and Analytica down 32%. Overall increase since the beginning of the year was 9.0%.

In April, there was an initial rise but this disappeared by the end of the month and stocks only rose 1.5% with the major gains being in the more expensive stocks with the most notable rises over 10% being QRxPharma (up 26%), Somnomed up (18%), Acrux (up 16%) and Biota, Cellestis, Mesoblast, Pharmaxis and Universal Biosensor (up 12-14%). Mid stocks Bionomics rose 12% but Tissue Therapies fell 27%, Probiotec 20% and CBio 19%. Notable movers in the cheaper stocks were Genetic Technologies up 76%, Living Cell up 44% and Solagran up 43% but Fluorotechnics fell 57%, Fermiscan 56%, Bone Medical 43% and SciGen 36%. Overall increase since the beginning of the year was 11.0%.

In May, overall there was a small increase but there were dramatic changes in individual stocks. For the more expensive stocks, notable movers were Bionomics up 21% and Starpharma up 25% whereas Pharmaxis fell 62% on bad news out of Europe, Universal Biosensor down 25%, IDT down 27% and Impedimed down 14%. For the cheaper stocks, there were a large number of improvers with the most notable being Viralytics up 75%, Narhex up 75%, Genetic Technologies up 61%, Neuren up 53%, bioMD up 42% (takeover), Benitec up 42%, Anteo up 36% and Calzada up 31%. There was an almost equal number that fell including Novogen down 33%, Agenix, CathRx, Karmelsonix and Living Cell (all down about 20%). Overall increase since the beginning of the year was 14.9%.

In June, there was a severe downturn particularly for the medium and cheaper stocks. For the expensive stocks, QRxPharma fell 20% and Cochlear and Clinuvel 10%. For the medium stocks, Pharmaxis fell 26%, Bionomics 21% and Biota 20% while Tissue Therapies increased 16%. There were many losers amongst the cheaper stocks with the most notable being Cordlife down 67%, Acuvax, Biodiem and Stirling down 50%, NuSep down 47%, Neuren down 39%, CathRx down 34%, Actinogen and Healthlinx down 33%, Avexa 32%, Patrys 31%, Bone 30%, Progen and Living Cell down 29% and Genera down 28%. Improvers from a low base were Genesis up 100%, Fermiscan up 50% and Optiscan up 37%. Hexima delisted and bioMD is changing its name to Allied Healthcare Group following reverse takeover. Overall increase since the beginning of the year was 2.2%. indicating a 10% drop overall in June.

In July, there was a general improvement in the more expensive stocks but cheaper stocks languished. Of the expensive stocks, notable improvers were Pharmaxis up 31%, Acrux up 21%, Cellestis up 19% (improved takeover offer), Alchemia up 16%, Somnomed up 16% and Bionomics up 15% but QRxPharma declined 13% and Unilife declined 14%. For the cheaper stocks, notable improvers were Holista Colltech up 87%, Optiscan up 59%, CathRx up 43% and Agenix up 29% and losers were Cordlife down 28%, Allied Healthcare (formerly bioMD) down 25%, Sunshine Heart down 24% and Atcor Medical down 23%. Chemgenex Pharma delisted following takeover by Cephalon. Overall increase since the beginning of the year was 2.0%.

In August there were notable declines in the cheaper and medium stocks. At the upper end of the market, notable declines were Alchemia down 52%, Bionomics down 24%, Starpharma down 24%, Somnomed down 17%, Universal Biosensor down 17% and Pharmaxis down 16%. Of the cheaper stocks, notable declines were CBio down 62%, Healthlinx down 32%, Atcor Medical down 30%, Brain Resource down 29%, Cordlife down 29% and Progen down 25%. Karmelsonix changed its name to iSonea and Cellestis delisted. Overall decrease since the beginning of the year was 8.0%.

In September, stocks fell across the board with both cheap and expensive stocks affected (average fall of 8.6%). Of the expensive stocks, notable falls were Cochlear down 39% due to product recall, Impedimed down 23%, Pharmaxis and Circadian down 22%, Biota down 19%, Acrux down 17% and Sirtex down 15%. Notable falls in the cheaper stocks were Allied Healthcare down 36%, CBio down 25%, Ellex Medical down 27%, Patrys down 26%, Progen down 36% and Uscom down 28%. Overall decrease since the beginning of the year was 17.1%.

In October, there was a 6% recovery with very mixed results across the board. There were noticeable recoveries in the medium to expensive stocks with Pharmaxis up 79%, QRxPharma up 36%, Impedimed up 32%, Cochlear up 26% and Tissue Therapies up 28%. Of the cheaper stocks, most noticeable were Neuren up 87%, Probiomics (merger talks) up 83%, OBJ up 38%, Cell Aquaculture up 38%, Allied Healthcare and Biotron up 28% and Phosphogenics up 27%. However, Holista Colltech fell 44%, Medigard 42%, Bone Medical 38%, iSonea 33% and Alchemia 22%. Overall decrease since the beginning of the year was 14.7%.

In November there was a further decline particularly in the medium and expensive stocks. Notable increases were Bionomics up 23% and IDT up 15% but the preponderance were down with notables being pSivida down 69%, Tissue Therapies down 30%, Mesoblast down 17%, Pharmaxis down 17%, Unilife Corp down 17%, Acrux down 16% and QRxPharma down 16%. For the cheaper stocks, improvers slightly outpaced losers with the notable ones being Antisense Therapeutics up 190%, Actinogen up 120%, Cordlife up 67%, Cryosite up 61% and Holista Colltech up 53%. However notable declines were iSonea down 60%, Imugene down 48%, Uscom down 40% and Healthlinx down 38%. Overall decrease since the beginning of the year was 16.6%.

In December the decline continued by a further 1.4%. Notable movers in the more expensive stocks were Bionomics up 16%, Cochlear up 12% and QRxPharma up 12% but Unilife fell 26% and Somnomed fell 16%. Of the other stocks, iSonea was up 75%, Optiscan up 44%, Progen up 33%, Genera Biosystems up 32%, Phosphagenics up 27% and Avita up 25% but CBio was down 67%, Bone Medical down 44%, Narhex Life down 39%, NuSep down 33%, Cell Aquaculture down 32%, Phylogica down 31% and Uscom down 26%. Overall decrease since the beginning of the year was 19.5%.

Of the expensive stocks in 2011, the winners have been Mesoblast up 48%, Cellestis (delisted) up 51% and Starpharma up 37% but Psivida is down 74%, Pharmaxis is down 65%, Resmed down 29%, Sirtex down 26%, Clinuvel Pharma down 25% and Cochlear 23%. Average decrease of 10.8%.

For the medium stocks, winners have been Bionomics up 90% and Chemgenex Pharma(delisted) up 54% but Universal Biosensor is down 51%, Tissue Therapies down 47%, Unilife Corp down 42% and Impedimed down 35%. Average decrease 3.4%.

For the cheaper stocks, winners have been Genetic Technologies up 233%, Antisense Therapeutics up 229%, Calzada up 115%, Phosphagenics up 75%, Neuren Pharma up 69%, Optiscan up 69%, Allied Health Group up 33%, Cryosite up 32% and Genesis R&D up 30% but on the other side, Bone Medical is down 88%, Healthlinx is down 85%, Cordlife down 78%, Imugene down 78%, Uscom down 77%, Fluorotechnics down 74%, CBio down 71%, Medigard down 71%, Stirling Products (administrators appointed) down 71%, Tyrian Diagnostics down 71%, NuSep down 70%, Cell Aquaculture down 68%, Genera Biosystems down 68%, Acuvax down 67%, iSonea down 67%, Living Cell Technologies down 66%, Patrys down 65%, CathRx down 64%, Fermiscan down 63%, Virax Holdings down 63%, Bioprospect down 60%, Ellex Medical down 57%, Solagran down 57%, Compumedics is down 53%, Alchemia down 52%, Agenix down 50%, SciGen down 48%, Cellmid down 47%, Cardia Bioplastics down 44%, Biotech Capital down 43%, Biodiem down 42%, Benitec Biopharma down 40%, Leaf Energy down 40%, Pharmanet down 40%, Probiotec down 40%, Phylogica down 38%, Resonance Health down 38%, IDT down 35% and Narhex Life Sciences down 31%. Average decrease 22.7%.

2010

As indicated in the graph below, most biotech stocks wandered lower in 2010 until around August when there was a significant improvement particularly in the more expensive stocks. The major contributors to this were Mesoblast up 243%, Tissue Therapies up 350%, QRxPharma up 79% and Acrux up 62%. There were also improvements in the cheaper stocks with Anteo Diagnostics up 1,114%, Phosphagenics up 76%, Ellex Medical up 69% and Clover up 53%. Significant declines were noted with Cellestis down 24%, Probiotec down 73%, Biota down 59%, IDT down 57%, Chemgenex down 54% and Genera Biosystems down 43%. There was the usual host of cheap stocks that also had severe falls including Fluorotechnics, Antisense Therapeutics, Acuvax, Novogen, CBio, Avexa, Bioprospect and Bone Medical.. A continuing theme was the persistent movement of companies out of the sector or morphing into another company. These included BPH Corp, Brainz Instruments, Incitive, Norwood Abbey, PharmAust and Xceed Capital moving into the resources sector, Polartechnics being liquidated and Aquacarotene being merged with Farmacule Bioindustries to form Leaf Energy. A number of other companies remain in limbo or in the process of moving out of the sector including Acuvax, Biotech Capital, Fermiscan, Fluorotechnics, Iatia, Narhex Life Sciences and Pallane Medical. Another notable development was the maturing of companies with the highest profile companies being Mesoblast ( with a market cap of over $1 billion), Pharmaxis, Acrux, Sirtex, Unilife Corp. and Universal Biosensor. Other companies on the threshold include QRxPharma, Starpharma, Chemgenex Pharma and Impedimed.

In January, it was expected that there would be a downward trend across the board to consolidate the rises of the previous year, but this only happened towards the end of the month. Speculation caused temporary rallies in a number of low cost stocks as a result of deals or trials announced, namely Anteo Diagnostics, Viralytics, Pharmanet and Patrys. There was also a significant rally in Mesoblast stocks. It remains to be seen whether any of these rallies can be retained. A number of stocks declined because they had risen too far in the previous year. These included BPH Corporate, SciGen, Xceed Capital and Biota. Rockeby Biomedical was delisted and a number of other companies are likely to follow suit in coming months. Average movement in January was up 5.0%

In February, prices were affected by half yearly financial reporting. At the upper end of the market, this clearly affected prices with CSL and ResMed up more than 10% but there were noticeable declines with Cellestis, IDT (down 33%), Mesoblast, Probiotec (down 32%) and Sirtex. Unilife is progressing well with its move to the US. The effect was more pronounced in mid stocks with declines by Circadian, Chemgenex (down 23% with trial results ambiguous), Novogen (down 20%), Progen and Uscom. Hexima went against the trend (up 16%). CBio bombed on debut with a 64% decline. Of the low end stocks, major movers were Brainz (up 62%), Healthlinx (up 125%) and Virax (up 110%) mainly as a result of speculation. Noticeable declines were CathRx down 35%, Holista down 33% and Medic Vision down 35%. Exits from the biotechnology industry are continuing with the delisting of Cytopia following acquisition by Canadian company, YM Biosciences, Narhex going into administration, agreement to wind up Polartechnics and announcement that Incitive would be changing to a resource company. Average movement since beginning of 2010 is up 5.6%.

In March, there were no significant trends overall, but notable changes in some shares. At the high end of the market there was a noticeable increase with rises of larger than 10% by Acrux, Cochlear and Psivida outweighing the 16% decline by Unilife as it starts its American adventure. The rest of the sector declined. In the mid stocks, while Circadian increased 33%, Chemgenex declined 38% following problems in gaining FDA approval. At the lower end, noticeable improvers were Living Cell up 35% and Phosphagenics up 44% and losers were Antisense Therapeutics ( down 56% with termination of arrangement with Teva), CathRx (down 46% with continuing sales problems) and Virax down 33%. Biosignal and Brainz Instruments left the biotech sector with others about to follow. Average movement since beginning of 2010 is up 2.6%.

April initially improved but by the middle of the month, there was a noticeable decline in stocks. At the high end of the market, there were improvements by Unilife (up 26%), Psivida (up 20%) and QRX (up 32%) but Biota fell 41%. At midlevels, declines continued overall with Cordlife up 25% but Uscom down 21%. At the lower end, there was also a general decline with Living Cell up 52%, Prana up 43% and PharmAust up 40%, but Fluorotechnics down 45%, Genesis down 35%, Analytica down 34%, Ellex down 34% and Hexima down 28%. Biosignal changed to RGM Entertainment, Incitive to Hawkley Oil & Gas, Brainz to Tango Petroleum and Medic Vision to Media3Corp. Average movement since beginning of 2010 is down 1.3%.

May was a terrible month with stocks declining an average of 10% as a result of general market uncertainty arising from the Global Financial Crisis. There were major declines by Acuvax (down 62%) and Avexa with halting of programs and resignation of CEO (down 75%). Bucking the trend was Ellex Medical up 38% despite still being undervalued. Of the expensive stocks, Biota declined 18%, Probiotec down 21%, Sirtex down 17%, Universal Biosensor down 16% and Unilife down 14%. Midlevel shares continued to decline with Progen down 18% and Uscom down 18%. Other significant declines were BioMD down 32%, CBio down 30%, Karmelsonix down 30%, Living Cell down 32% and Pharmanet down 33%. Average movement since beginning of 2010 is down 9.8%.

In June, declines continued at a similar frightening rate to May with an 8.7% decline in prices compared to an overall decline of 17.2% since the beginning of the year. At the upper end, there were noticeable declines by Pharmaxis (33%) and Psivida (21%) but some recovery by Universal Biosensor (12%). Mid stocks were hit hard with Circadian down 25% and Genera Biosystems down 21%. At the lower end, there were many losses with the most notable being Novogen (58%), Telesso Technologies (63%), Stirling Products (40%) and Phosphagenics (35%). Declines of 20% or more were not unusual. Bucking the trend was CathRx up 61%. Lack of noticeable progress, uncertain clinical trial results and general depression in the market contributed to the mass decline. Average movement since the beginning of 2010 was down 17.2%.

There was a 4% recovery in July with notable improvers being Biodiem up 36%, Imugene up 50%, Atcor up 30%, Circadian up 20%, Impedimed up 22%, Solagran up 48%, Stirling up 83% and Uscom up 36%. Only significant declines were Cell Aquaculture down 31%, PharmAust down 46% and QRx Pharma down 20%. Average movement since beginning of year was down 16.2%.

Uncertainty about the global economy resulted in a further decline of 4.3% in August. Improvers were Actinogen up 159% and Imugene up 37% with declines by Aquacarotene down 40%, Atcor down 30%, Medigard down 37%, PharmAust down 30% and Virax down 59%. Of the expensive stocks, Somnomed rose 11% but Cellestis and Unilife were down 15% and Probiotec down11%. Average movement since beginning of year was down 20.7%.

Recoveries in selected stocks resulted in a 2.6% overall improvement in September. Of the expensive stocks, Mesoblast (merger with Angioblast) and Psivida (profitability) rose 40% and Acrux rose18% while Probiotec languished (down 23%). There were major changes in the cheaper stocks: Agenix (returning to the market) up 106%, Benitec (patent win) up 74%, Ellex Medical (profitability) up 69%, Actinogen (new discovery) up 57%, CathRx up 57%, Aquacarotene (merger with Farmacule) up 50% and Holista Colltech up 33%. However, problems with Fluorotechnics continued (down 70%) and support for SciGen declined (down 30%). Average movement since beginning of year was down 17.6%.

There were further improvements in October with 6.1% overall increase. Of the expensive stocks, notable improvers were Tissue Therapies up 89%, Chemgenex up 59%, Pharmaxis up 30%, Acrux up 26%, Starpharma up 25%, Sirtex up 24% and Psivida up 18%. Similar improvements in cheaper stocks with notables being BioMD up 119%, Hexima up 51%, Avexa up 45%, Biotron up 44%, Holista up 40%, Phosphagenics up 29% and Uscom up 28%. Losers were Atcor down 33%, Agenix down 29% and SciGen down 45%. Average movement since beginning of year was down 12.8%.

November brought little overall change (up 0.5%) with increases by expensive stocks being balanced by declines in cheap and mid stocks. Of the dearer stocks, notable improvers were Mesoblast up 36%, Alchemia up 20%, Acrux up 13% and Cochlear up 10% balanced by Probiotec down 37%, Genera Biosystems down 17% and Chemgenex down 17%. Of the cheaper stocks, notable movers were Cellmid up 105%, Analytica up 35%, Biotron up 30%, Ellex up 25% and Bionomics up 20% but Antisense Therapeutics down 43%, Holista Colltech down 25% and Progen down 20%. Average movement since the beginning of the year was down 12.8%.

In December, there was a 6.3% improvement overall with the major improvers being Compumedics up 81%, Optiscan up 80%, Anteo Diagnostics up 60%, Tissue Therapies up 58%, Prima Biomed up 55%, Sunshine Heart up 44%, QRxPharma up 37%, Mesoblast up 35%, Biodiem up 26%, Clinuvel up 22% and IDT up 18%. Notable declines were Actinogen down 37%, Cellmid down 27%, Uscom down 26% and Hexima down 22%. Average movement since the beginning of the year was down 3.9%

Of the expensive stocks in 2010, the winners have been Mesoblast up 243%, QRxPharma up 79%, Acrux up 62% and Resmed up 18% and major losers are Cellestis down 24% and Sirtex down 20%. Average increase of 35%.

For the medium stocks, the major winners have been Tissue Therapies up 350% and Starpharma up 20% but losers have been Probiotec down 73%, Biota down 59%, IDT down 57%, Chemgenex Pharma down 54% and Genera Biosystems down 43%. Average increase 6%.

For the cheaper stocks, significant winners have been Anteo Diagnostics up 1,114%, Phosphagenics up 76%, Ellex Medical up 69%, BPH Corp up 65%, Clover up 59%, Pharmanet up 43% and Agenix up 41%. Losers have been Fluorotechnics down 91%, Antisense Therapeutics down 87%, Acuvax down 82%, Narhex Life Sciences down 81%, Novogen down 80%, CBio down 79%, Avexa down 75%, Bioprospect down 74%, Bone Medical down 69%, SciGen down 63%, Genesis R&D down 62%, Biotech Capital down 58%, Uscom down 58%, Neuren Pharma down 57%, Select Vaccines down 57%, Tyrian Diagnostics down 56%, CathRx down 55%, PharmAust down 55%, Probiomics down 55%, Phylogica down 53%, Virax down 51%, Atcor Medical down 50%, Stirling Products down 50%, Progen Pharma down 49%, Solagran down 46%, Cordlife down 45%, Karmelsonix down 45%, Medigard down 45%, Atcor Medical down 43%, Leaf Energy (Aquacarotene) down 43%, Living Cell Technologies down 39%, Imugene down 38%, Biodiem down 37%, Telesso Technologies down 37%, Benitec down 34%, Analytica down 33%, Avita Medical down 33%, Brain Resource down 33% and OBJ down 31%. Average decline 11%.

2009

The year was a watershed for the biotechnology industry following the disastrous falls of 2008. Some larger companies finally showed clear evidence of substantial commercialisation and other companies moved closer to generating income. On the other hand a large number of companies disappeared either through acquisition by other companies, delisting or moving into other business sectors. As can be seen in the following graph, the improvements were most noticeable at the more expensive end of the market with almost a 200% average increase with major improvers being growing companies Sirtex, Biota and Cellestis and companies with substantially improved commercial prospects such as Universal Biosensor, Unilife Medical, Alchemia, Pharmaxis, Chemgenix and QRxPharma.

However there was a major shift out of the industry. Arana Therapeutics was acquired by Cephalon and Peplin by LEO Pharma. Cytopia is in the process of merging into YM BioSciences. Other companies disappearing were Advanced Ocular Systems (business change), Ventracor (liquidation), Stem Cell Sciences (acquired), Genesis Biomedical (change of business), Australis Aquaculture (administration), Biosignal (change of business), Diversa (change of business), Life Therapeutics (change of business). Companies in difficulties include Polartechnics ( voluntary administration), Fermiscan (voluntary administration), Agenix (problems with business acquisition in China), Dia-B Tech (Pallane Medical) (underwriting problems), Avastra Sleep Centres (administration), NuSep (merger problems), Rockeby Biomed (delisting), Medic Vision (change of business) and Freedom Eye (change of business).

There were a number of name changes including Metabolic Pharmaceutics to Calzada, Medical Therapies to CellMid, Dia-B Tech to Pallane Medical, Colltech to Holista Colltech, Apollo Life Sciences to Apollo Consolidated, BioPharmica to BPH Corporate, Freedom Eye to FYI Resources, Australis Aquaculture to AAQ Holdings and Cardia Technologies to Cardia Bioplastics.

During the year, concerns about swine flu outbreaks pumped share prices for a number of companies with varying longer term effects. Biota gained substantially, but other companies including Imugene, Rockeby Biomed, BioDiem and Actinogen only gained in the short term. There are also a number of companies in which shareholders have shown considerable faith although commercialisation remains remote. Companies include SciGen, Genera Biosystems, Prima Biomed, Bone Medical, Cellmid and Biopharmica.

Of the expensive stocks so far in 2009, the most significant winners have been Biota up 619%, Acrux up 359%, Sirtex up 348%, Psivida up 223%, Universal Biosensor up 214%, Pharmaxis up 125%, Cellestis up 87%, (Arana Therapeutics up 69%), Probiotec up 66%, Mesoblast up 36% and Cochlear up 25%. The only significant loser is IDT down 18%. Average gain 161%.

For the medium stocks, significant winners have been Alchemia up 350%, QRxPharma up 290%, Unilife Medical up 277%, Starpharma up 256%, Genera Biosystems up 231%, (Peplin up 160%), Cordlife up 120%, Somnomed up 115%, Chemgenex Pharma up 112%, Uscom up 61%, CathRx up 24% and Cirdacian up 21%. Significant loser has been Progen down 29%. Average gain 111%.

For the cheaper stocks, the significant winners have been Prima Biomed up 2900%, SciGen up 900%, OBJ up 480%, Brainz Instruments up 443%, Avita Medical up 358%, Probiomics up 340%,Biopharmica up 311%, Neuren Pharma up 270%, Stirling Products up 250%, Phylogica up 238%, Biodiem up 229%, Resonance Health up 180%, Immuron up 173%, Karmelsonix up 171%, Biotech Capital up 161%, Bioprospect up 160%, Pharmanet up 133%, Medigard up 122%, Living Cell Technologies up 120%, Avexa up 109%, Biosignal up 109%, Iatia up 100%, Pharmaust up 100%, Cogstate up 97%, Virax Holdings up 90%, Ellex Medical up 80%, Cryosite up 79%, Tissue Therapies up 68%, Bionomics up 67%, Antisense Therapeutics up 57%, Solagran up 56%, Brain Resource up 50%, Cell Aquaculture up 50%, Optiscan up 46%, Holista Colltech up 45%, Compumedics up 40%, Healthlinx up 38%, Clover up 36% and Avastra Sleep Centres up 33%. Losers have been Apollo Consolidated down 99%, Fermiscan down 85%, Incitive down 77%, NuSep down 71%, Anteo Diagnostics down 65%, Fluorotechnics down 60%, Xceed Capital down 60%, Polartechnics down 59%, Rockeby Biomed down 57%, Prana Biotech down 52%, Tyrian Diagnostics down 47%, Analytica down 43%, Medic Vision down 43%, Cytopia down 42%, Bone Medical down 40%, Freedom Eye down 40%, Bone Medical down 33%, Acuvax down 32%, Aquacarotene down 31%, Medical Therapies down 31% and Neurodiscovery down 30%. Average gain 103%.

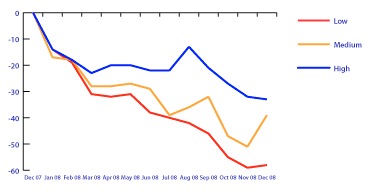

2008

As can be seen in the graph below, 2008 was a catastrophic year for the Australian biotechnology sector and particularly for listed companies. Shares fell by an average of about 55% with major losses in cheap stocks but also in other stocks (see graph and percentages below). The decline was caused initially by the effects of the subprime crisis, recession fears and impacts on margin calls pushing down prices. There was some recovery in August but increasing concerns about recession resulted in significant declines from September onwards.

There were a number of name changes which occurred mainly later in the year: Eiffel Technologies to Telesso Technologies, Avantogen to Acuvax, Anadis to Immuron, BioLayer to Anteo Diagnostics, Life Therapeutics to Arturus Capital, Solbec Pharma to Freedom Eye, Ambri to Diversa and Proteome Systems to Tyrian Diagnostics. Some companies disappeared due to takeover (Perseverance) or by re-domiciling to the US (Heartware). Visiomed and Clinical Cell Culture merged to form Avita Medical, Avexa and Progen are in the process of merging despite opposition by some shareholders and Cytopia. Metabolic Pharmaceuticals attempted to acquire PolyNovo from Xceed Capital but as a result of shareholder opposition, finished up with 60% of the company. Agenix's acquisition of a Chinese company has hit a number of snags. Chemgenex attempted to spin out Verva Pharmaceuticals as a listed entity but this has been delayed due to market deterioration. Many companies experienced difficulties during the year and the drastic lack of finance towards the end of the year resulted in price cutting, down sizing, appointment of administrators over subsidiaries (Anadis) or over the entire company (Apollo Life Sciences) and the offloading of assets.

More detailed information below.

January was dominated by the effects of the subprime crisis and concerns about a recession in the US which affected the market as a whole. More established stocks were more affected than the speculative stocks with falls of around 20% but up to 40% in the short term. Some recovery occurred towards the end of the month. All $1 plus stocks fell except for Novogen, CSL and QRx with the main losers being Universal Biosensor, Pharmaxis and Cellestis. Average loss was 14%. For the mid stocks, all fell with major ones being Biota, Alchemia and Cytopia. Average loss was 17%. For cheaper stocks, 75% fell and 14% rose. Average loss was 12%.

In February, there was a further decline in stocks with more expensive stocks falling further, medium stocks stabilising and cheaper stocks continuing their slide. Eiffel Technologies changed its name to Telesso Technologies following a consolidation, Perseverance was acquired and ceased its listing and Visiomed Group merged into Clinical Cell Culture. Only share really bucking the trend was Antisense Therapeutics up 76% whilst notable failure was Avastra down 68%. Average loss was 19%.

In March, share price declines continued although less so in the more expensive stocks (see below) and there were indications at the end of March that some of the more reliable stocks were recovering. Perseverance and Visiomed disappeared from the register and Eiffel changed to Telesso. Lack of investment capital for some stocks has resulted in a number of companies appearing to be in difficulty including Life Therapeutics, Apollo Life Sciences, Anadis, Brainz, Colltech, Narhex Life Sciences, PharmAust, Stem Cell Sciences and Xceed Capital. Some companies are offloading assets including Apollo, Anadis and Agenix. Credit must be given to companies that are unaffected by the market malaise, notably CSL, Biota and Antisense Therapeutics. Average loss 29%.

In April, Opes Prime collapse continued to affect general sentiment with cheap to medium stocks remaining down but there was some recovery in the more expensive stocks although there was some reversal towards the end of the month. Key improvers remain Novogen, Clinuvel and Antisense with serious declines in Pharmaxis, CathRx, Solagran, Avastra, Apollo and Life Therapeutics. Questions of survivability of a number of companies remains. Average loss 30%.

In May, the hoped for recovery did not arrive and most shares languished as the Opes Prime fallout and concerns about inflation affected the market. Exceptions were Cell Aquaculture, Cogstate, Heartware, Hexima and Psivida. Average loss 29%.

In June, shares continued to languish as a result of general market downturn with the cheaper stocks being harder hit. Those defying the trend were Acrux, Cell Aquaculture, Chemgenex Pharma, Somnomed and Unilife. Average loss 36%.

In July, the decline in the share prices of the sector continued with the mid-priced shares in particular being hit with most notable being Progen , Circadian and Fermiscan. Others declining were Biota, CSL, IDT, Novogen, Sirtex, Agenix, Genetic Technologies and Karmelsonix. Increases occurred with Cordlife, Mesoblast and Psivida. Notable was proposal by Metabolic Pharmaceuticals to acquire PolyNovo Biomaterials. Average loss 38%.

In August, there was a noticeable improvement in the more expensive stocks (see below) with recoveries by Cochlear, CSL, Mesoblast, Novogen, Pharmaxis and ResMed. However, both the cheaper and medium stocks continued to languish. Average loss 38%.

In September, the international credit crisis had a major effect with recovery in expensive stocks stalling, decline in cheap stocks continued and a small recovery in medium stocks occurred. The difficult situation in a number of biotech companies was exacerbated with 26 having less than $1 million in liquidity and 44 with less than $2 million. 10 companies have negative non-cash value and 61 have non-cash value less than $10 million. Notable improvements in the month were Clover and Sunshine Heart up 50% while notable losers were Arana (down 20%), Alchemia (30%), Acrux (20%), Avexa (40%), Chemgenex (30%), Novogen (30%), Peplin (20%) and Psivida (45%). Average loss to end of September 42%.

In October, the world melt down in markets had a major impact on stocks with all categories down. For some companies, the difficult outlook meant introduction of price cutting regimes and staff reductions (Alchemia and Ventracor), others went into administration (Apollo Life Sciences) or sold off key assets (Brainz Instruments). Significant price drops occurred with Brain Resources, Biota, Chemgenex, Hexima, Optiscan, Patrys, Psivida and Ventracor. Among this, the listing of Fluorotechnics went well. Average loss to end of October 52%.

In November, the pain continued with further declines most notably with Acrux, Antisense, Circadian, CSL, Chemgenex, Fermiscan, Hexima, Peplin, QRx, Starpharma and Stirling. Bucking the trend were Atcor and Analytica and Fluorotechnics as a new arrival with little sign of price decline. Cost cutting and staff reduction announcements were common so were company name changes: Avantogen to Acuvax, Anadis to Immuron, Biolayer to Anteo Diagnostics, Life Therapeutics to Arturus, Solbec to Freedom Eye and Proteome Systems to Tyrian Diagnostics. Also notable were appointment of administrators for Apollo, the rolling of the board of Genetic Technologies and shareholder rejection of proposed acquisition of PolyNovo from Xceed by Metabolic. As an indicator of the rapidly declining situation, 35 companies have less than $1 million in liquidity and 52 with less than $2 million. 17 companies have negative non-cash value and 78 have non-cash value less than $10 million (cf the situation given a few paragraphs above). Average loss to end of November 56%.

Of the expensive stocks so far in 2008, there have been no clear winners. Significant losers have been Pharmaxis down 71%, Psivida down 65%, Sirtex Medical down 63%, Cellestis down 43%, IDT down 31% and Cochlear down 26%. Average loss 33%.

For the medium stocks, there have been no clear winners. Significant losers have been CathRx down 81%, Progen down 70%, Acrux down 66%, Universal Biosensor down 60%, Chemgenex Pharma down 56%, Circadian down 52%, Novogen down 44%, Arana Therapeutics down 28% and Mesoblast down 22%. Average loss 39%.

For the cheaper stocks, the only significant winners have been Analytica up 331%, Uscom up 67% and Atcor Medical up 63%. Losers have been Avastra down 97%, Brainz Instruments down 96%, Rockeby Biomed down 95%, Biosignal down 94%, Neuren Pharma down 94%, Karmelsonix down 92%, Stirling Products down 92%, Agenix down 90%, Ventracor down 89%, Ellex Medical down 88%, Iatia down 88%, Probiomics down 88%, Avita Medical (Clinical Cell Culture) down 87%, Avexa down 86%, OBJ down 86%, Solagran down 86%, Tyrian Diagnostics (Proteome Systems) down 85%, Norwood Abbey down 84%, Life Therapeutics down 83%, Telesso Technologies down 83%, Actinogen down 82%, Optiscan down 82%, QRxPharma down 82%, Advanced Ocular Systems down 81%, Dia-B Tech down 80%, Fermiscan down 80%, Patrys down 79%, Apollo Life Sciences down 78%, Phylogica down 78%, Alchemia down 77%, Cardia Technologies down 76%, Prima Biomed down 76%, Select Vaccines down 76%, Stem Cell Sciences down 76%, NuSep down 74%, Biota down 73%, Living Cell Technologies down 73%, PharmaNet down 73%, Tissue Therapies down 73%, Colltech down 71%, Freedom Eye (Solbec Pharma) down 71%, Genesis Biomed down 71%, Phosphagenics down 71%, Sunshine Heart down 71%, Immuron (Anadis) down 70%, Genetic Technologies down 67%, Xceed Capital down 67%, Cytopia down 66%, BioPharmica down 65%, Genesis R&D down 65%, Virax Holdings down 65%, Biodiem down 64%, Benitec down 63%, Bioprospect down 63%, Biotech Capital down 63%, Incitive down 63%, Peplin down 63%, Anteo Diagnostics (Biolayer Corp.) down 62%, SciGen down 62%, Cordlife down 61%, Hexima down 61%, Medical Therapies down 60%, Narhex Life Sciences down 60%, Acuvax (Avantogen) down 59%, Diversa (Ambri) down 58%, Neurodiscovery down 58%, Australis Aquaculture down 57%, Medic Vison down 57%, Brain Resource down 56%, Medigard down 55%, Polartechnics down 54%, Cryosite down 53%, Genera Biosystems down 52%, Viralytics down 52%, Starpharma down 51%, BioMD down 50%, Bone Medical down 49%, PharmAust down 48%, Bionomics down 46%, Imugene down 43%, Cell Aquaculture down 39%, Prana Biotech down 38%, Healthlinx down 37%, Metabolic Pharma down 37%, Biotron down 33%, Resonance Health down 33%, Clinuvel Pharma down 30% and Unilife Medical down 30%. Average loss 58%.

2007

In early 2007, there was a silly season in which a number of stocks recorded speculative jumps resulting in speeding tickets from the ASX. By the end of February, some semblance of sanity returned to the market but significant jumps which have been retained include the speculative jump (up 71%) in Benitec shares associated with a sublicensing arrangement with Pfizer, a 100% increase in Solagran shares, a 108% increase in Avexa shares associated with high expectations for apricitabine, a 58% increase in Avastra shares associated with optimism about a change of direction and a 106% increase in Fermiscan shares followed by a loss returning to the level at the beginning of the year. Noticeable has been the proposed merger announced in May between Peptech and EvoGenix resulting in Arana Therapeutics, the 82% fall in Metabolic shares with trial results indicating that its lead compound is not commercially viable and a subsequent fall with discontinuation of clinical trials on pain drug, the 78% fall for Chemeq as a result of litigation which has resulted in the company going into administration/receivership and the sharp 45% fall by Clinical Cell Culture and continuing decline following revision of revenue outlook. This resulted in a proposal for merger with another listed company, Visiomed Group. Vision Systems was delisted in February. There was a noticeable weakening of the more fragile stocks in May and this continued through to August when all stocks were affected. In September, there was some recovery by the more expensive stocks. Panbio was suspended in December as a result of approval for take over by Inverness. Major winners and losers noted below.

While the first six months of the year saw a resurgence in share prices of a number of biotechnology companies, there was a significant downturn after June. Over the last six months of 2007 the major winners were Living Cell Technologies up 160% and Panbio up 126%. In the same period, there were a number of significant losers, those being Metabolic down 69%, Clinuvel down 61%, Actinogen down 56%, Pharmanet down 56%, Fermiscan down 55%, Life Therapeutics down 53%, Neuren Pharma down 50% and NuSep down 50%,.

Of the expensive stocks in 2007 winners have been Solagran up 242%, Acrux up 84%, Chemgenex up 75%, CSL up 67%, Sirtex up 67%, Pharmaxis up 42%, Universal Biosensors up 32%, Cochlear up 29% and IDT up 21%. Significant losers have been Progen down 57%, Novogen down 52%, QRxPharma down 45%, Mesoblast down 30%, Arana Therapeutics down 29%, Biota down 24% and Circadian down 22%.

For the medium stocks, winners were Cordlife up 124%, Panbio up 105%, Avexa up 80%, Bionomics up 79%, Brain Resources up 70% and Avastra up 22%. Significant losers were Ventracor down 45%, Stem Cell Sciences down 42% and Australis Aquaculture down 31%.

Of the cheaper stocks, main movers were Karmelsonix up 243%, BioProspect up 105%, Bone Medical up 95%, Living Cell Technologies up 92%, Unilife up 53%, Polartechnics up 52%, Visiomed Group up 42%, Eiffel Technologies up 41% and Healthlinx up 33%. Significant losers were Metabolic down 95%, Life Therapeutics down 79%, Clinical Cell Culture down 77%, Uscom down 73%, Advanced Ocular Systems down 70%, Anadis down 66%, Brainz Instruments down 66%, Biolayer down 65%, PharmAust down 65%, Colltech down 64%, NuSep down 64%, Psivida down 63%, Apollo Life Sciences down 60%, Chemeq down 60%, Phylogica down 60%, Ambri down 58%, Prima Biomed down 58%, Genetic Technologies down 57%, Virax down 56%, Neuren Pharma down 55%, Actinogen down 53%, Atcor Medical down 53%, Clinuvel Pharma down 52%, Genesis Biomed down 52%, Narhex Life Sciences down 52%, Pharmanet down 50%, Perseverance down 47%, Imugene down 45%, Medical Therapies down 45%, Stirling Products down 45%, Viralytics down 44%, Aquacarotene down 42%, Analytica down 41%, Cogstate down 41%, Incitive down 41%, Sunshine Heart down 39%, Medic Vision down 38%, OBJ down 38%, Norwood Abbey down 36%, Resonance Health down 35%, Tissue Therapies down 35%, Optiscan down 33%, Probiomics down 33%, Biodiem down 32% and Neurodiscovery down 31%.

2006

In 2006 there was continuing strong support for established biotech companies such as Sirtex, Life Therapeutics, GroPep, CSL, Ellex Medical, Cochlear and Vision Systems and a downward trend among the cheaper stocks. There was increasing negative sentiment across the board in May and June even for the stronger stocks as part of an overall market correction. July and August were relatively quiet except for takeover and merger activities which have affected selected stocks. Welcome developments were the absorption of Meditech Research by Alchemia which may be the forerunner of an overdue consolidation in the industry, the merger of CSL and Zenyth Therapeutics, the successful takeover of BresaGen by Hospira Inc., the takeover of Vision Systems by Danaher and the offer by Novozymes A/S for GroPep. Further signs have been the acquisition of Promics by Peptech to strengthen its portfolio, the merger of Ambri and Glykoz and the offer for Panbio by Inverness. Three moribund companies were undergoing rejuvenation; Genesis Biomed, Cryptome Pharmaceuticals (now called HealthLinx) and Environmental Solutions International. Another company, Eiffel Technologies, announced interest in merger and acquisition opportunities. Chemeq's survival remained under question, as did Acuron and Avantogen.

Of the expensive stocks, significant movers were Fermiscan (new listing) up 247%, Universal Biosensors (new listing) up 124%, Vision Systems up 125% (takeover by Danaher virtually complete), CathRx up 108%, Progen up 108%, Mesoblast up 55%, CSL up 54%, GroPep up 50% (takeover by Novozymes - delisted), Pharmaxis up 43%, Sirtex up 35%, Circadian up 35%, Cochlear up 27% and ResMed up 21%. The only significant loser was Novogen down 48%.

Of the mid stocks, the main movers were Evogenix up 118%, Clinuvel Pharma up 113%, Ellex Medical up 106%, Phylogica up 88%, Metabolic up 79%, Zenyth Therapeutics (takeover - now delisted) up 74%, Australis Aquaculture up 42%, Peplin up 30%, Optiscan up 28% and Uscom up 25%, and losers were Alchemia down 33%, Cytopia down 25%, Neuren Pharma down 25%, Brainz Instruments down 20% and Tissue Therapies down 23%.

Of the cheap stocks, the winners were Cardia Technologies up 217%, Polartechnics up 138%, Avastra up 132% (company redirection), Prana Biotech up 100%, Solagran up 97%, Cogstate up 91%, Sunshine Heart up 40%, Compumedics up 39%, BioMD up 38%, BresaGen up 38% (takeover almost complete - shares suspended), Imugene up 38%, Phosphagenics up 39% and Virax up 31%. Losers were Norwood Abbey down 88%, Somnomed down 88%, Select Vaccines down 83%, Resonance Health down 78%, Advanced Ocular Systems down 77%, Healthlinx down 71%, Chemeq down 70%, Acuron down 66%, Psivida down 65%, Biodiem down 62%, Atcor Medical down 60%, Biopharmica down 58%, BioLayer down 57%, Clinical Cell Culture down 57%, Dia B Tech down 56%, Avantogen down 54% (suspended), Solbec Pharma down 54%, PharmaNet down 53%, Stirling Products down 53%, Bone Medical down 52%, Benitec down 49%, Agenix down 48%, Prima Biomed down 46%, Unilife Medical down 44%, Visiomed Group down 43%, Eiffel Technologies down 39%, Incitive down 33%, Rockeby Biomed down 32%, Aquacarotene down 31%, PharmAust down 31%, EQiTX down 30%, OBJ down 30% and Viralytics down 30%.

2005

In 2005 there was a strong early trend downwards among both the cheaper stocks and the medium stocks with some signs of recovery after mid May, particularly in the medium and dearer stocks but there was a decline at the end of August and then a clear improvement in selected stocks in October. The more expensive stocks generally have been balanced between improvers and losers.

Highlights in 2005 have been the improvements in sales and profitability by Resmed, Cochlear, CSL, GroPep and Vision Systems, the rapid rise of Pharmaxis, Biota, Life Therapeutics, OBJ, Mesoblast, Cochlear, Resmed, Peplin, Alchemia, Heartware, Ellex Medical, Evogenix, CSL and SciGen shares and the entry into provisional liquidation of AVT Plasma. However there have been worrying falls by Select Vaccines, Acuron, Polartechnics, Avastra, Compumedics, BioProspect, Antisense Therapeutics, Benitec, Virax Holdings, Avantogen, Cardia Technologies, Metabolic Pharmaceuticals, Prana Biotechnology, Uscom, Epitan, Eiffel Technologies, Narhex Life Sciences, Somnomed, Colltech, Cryptome Pharma (now HealthLinx), Probiomics, Stirling Products, Sunshine Heart, Genesis R&D, Living Cell Technologies, Analytica, Cogstate, Proteome Systems, Unilife Medical, Clover, Agenix, BioMD, Circadian and Psivida,.

Of the more expensive stocks, major movers have been Pharmaxis up 174%, Biota up 173%, Life Therapeutics up 127%, Mesoblast up 89%, Cochlear up 81%, ResMed up 62%, Alchemia up 51%, CSL up 45%, GroPep up 44% and Vision Systems up 31%, recovery has occurred with Cellestis and Ventracor while losers have been Circadian down 45%, Progen down 39%, Peptech down 22%, IDT down 21% and Ventracor down 20%.

Improvers in the mid stocks have been Peplin up 52%, Ellex Medical up 49%, Cytopia up 35% and BioDiem up 25% and newcomers Heartware up 50%, Brainz Instruments up 30% and Neuren Pharmaceuticals up 33%. Recoveries have occurred with Australis Aquaculture, Biotech Capital, Chemgenex and Zenyth Therapeutics and losers have been Uscom down 66%, Metabolic down 64%, Chemeq down 44%, Bone Medical down 44%, Psivida down 43%, Starpharma down 36%, Norwood Abbey down 25%, Acrux down 25% and Tissue Therapies down 24%.

At the low end of the market, the improvers have been OBJ up 108%, SciGen up 48%, Cell Aquaculture up 40%, Evogenix up 36%, Biopharmica up 33%, Avexa up 30% and SSH Medical (now BioLayer Corp) up 30% and there have been significant recoveries by Bionomics, Biotron, Bresagen, Cogstate, Cygenics, Imugene, Meditech Research, Optiscan, Phosphagenics, Phylogica, Psiron, Rockeby Biomed and Xceed Biotechnology but losers have been Select Vaccines (77%), Acuron (76%), Polartechnics (75%), Avastra (74%), Compumedics (73%), BioProspect (72%), Antisense Therapeutics (71%), Benitec (70%), Virax Holdings (67%), Avantogen (66%), Cardia Technologies (66%), Prana Biotechnology (64%), Epitan (63%), Eiffel Technologies (60%), Narhex Life Sciences (60%), Somnomed (60%), Colltech (59%), Cryptome Pharma (58%), Probiomics (58%), Stirling Products (58%), Sunshine Heart (58%), Genesis R&D (54%), Living Cell Technologies (53%), Analytica (52%), Cogstate (52%), Proteome Systems (51%), Unilife Medical (51%), Clover (50%), Agenix (47%), BioMD (47%), Ambri (44%), Solbec Pharma (44%), Cygenics (43%), Biosignal (42%), EQiTX (42%), Premier Bionics (39%), Dia-B Tech (38%), IATIA (38%), Meditech Research (35%), PANBIO (31%), Imugene (30%), Resonance Health (30%), Solagran (30%), Prima Biomed, Visiomed Group, Clinical Cell Culture, PharmaNet, PharmAust, Medigard, Rockeby Biomed and Medical Therapies.

2004

For 2004, the overall trend was one of lethargy and disinterest with most minor stocks remaining level or drifting down, a growing trend to mid range companies and a move to the more established companies which have recorded increases of 20% or more. There seemed to be a strong movement away from the speculative stocks to the security of the more established stocks. We also noted two significant gaps developing between the stocks valued at less than $120 million, stocks valued around $140-200 million and those more than $260 million as a result of the shift to the more secure companies.

Notable developments were the merger talks between Peptech and Agenix (discontinued ), the entry of BresaGen into voluntary administration (relisted December), the entry of Environmental Solutions into receivership, the mergers with US companies (Benitec, Chemgenex (AGT Biosciences), Life Therapeutics (Gradipore)), the sale of Axon and the push by other companies such as Avantogen (then Australian Cancer) and Bionomics into the US market and the mass of floats that have taken place including Australis Aquaculture, Avastra, Biosignal, Biopharmica, Cygenics, Living Cell Technologies, Bone, Xceed Biotech, Regenera (now Advanced Ocular Systems), Genepharm, Avexa, Sunshine Heart, Acrux and Proteome Systems.

Of the more expensive stocks, Progen almost tripled in price, Cellestis was up 90% based on expectations of future sales in the US and Japan, and Psivida rose 130% based on good international promotion. There was also a recovery by CSL (up 55%). Cochlear, Circadian, Metabolic, Resmed, Sigma and Vision Systems also increased 20% or more. Significant falls occurred with Chemeq (80%), Novogen (25%), Sirtex (40%) and Ventracor (35%) associated with a dawning shareholder perception of reality.

Of the midrange stocks, new entries did well with Australis up 50%, Living Cell up 70%, Pharmaxis up 90% and Stirling up 60% (although Proteome Systems fell heavily). Other improvers were Alchemia up 35%, Anadis up 85%, Epitan up 35% and Virax up 55%. Significant falls of more than 30% occurred with Agenix, Biodiem, Benitec (50%), Cygenics, Genesis R&D, Norwood Abbey (55%), Peplin(45%), Polartechnics (50%) and Unilife (65%).

For the cheaper stocks, only 7 out of 48 increased. Increases occurred with Australian Cancer (55%), Cardia, Iatia (100%), Phosphagenics (75%), Perseverance, Solagran (40%) and Xceed Biotech. Falls of 30% or more occurred with Ambri (50%), AVT (65%), Bresagen (65%), Cogstate (50%), Clover (40%), Cryptome (45%), Cryosite (35%), Eiffel (50%), Genesis Biomed (30%), Medigard (60%), Meditech (40%), PanBio (40%), Prima Biomed (60%), Rockeby (75%), SciGen (30%) and Visiomed (60%).